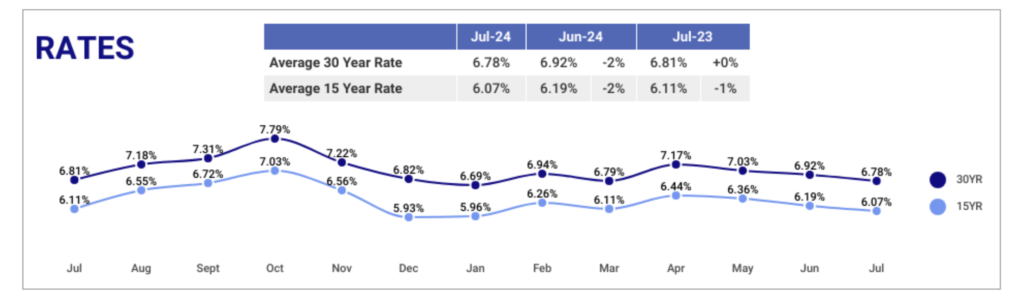

Many people may be thinking they will wait for the Fed to cut rates to take action. This was the case in the 1970s and 1980s, when the market responded after cuts were made. We live in a world now where interest rates may drop just by the talk of it, and not necessarily after the actual rate cut happens. If you are considering buying based on rates going down, don’t wait until the Fed acts to get the benefit of it.

What will fall bring? We normally enter a seasonal decline in the local real estate market but with potential rate cuts and elections two months away, the usual seasonal fluctuations we see may be out the door. Talk of rate cuts are starting to pique the interest of many sidelined buyers. Studies show that a wave of buyers are likely to be unlocked in the 5’s and savvy buyers may want to be proactive.

Demand in the market continues to remain strong with closings over 2,300 in July. Our market is roughly where it was at during the same time last year, except home prices are around 2% higher.

Active listings continue to creep higher, however in a market that is still undersupplied in housing, we know this is getting us closer to a normalized market.

Months of supply serves as a barometer for market health. We are currently at 4 months which should give those paying attention confidence that prices may slow their rise, but are unlikely to go backwards to a significant degree.

If you are interested in preparing to buy and shopping for rates, let me direct you to one of my lenders who can help.