If you’re looking at Florida to buy or sell real estate and listening to national news you may be led to act, or not to act, based on false information. It’s no wonder people are confused. Real estate is local business and national headlines making claims about the market really aren’t helpful. It’s like the weather; it wouldn’t make sense to do a forecast for the entire USA, would it?

Here are the answers behind the questions I’m most asked:

- Am I getting a rate that’s too high?

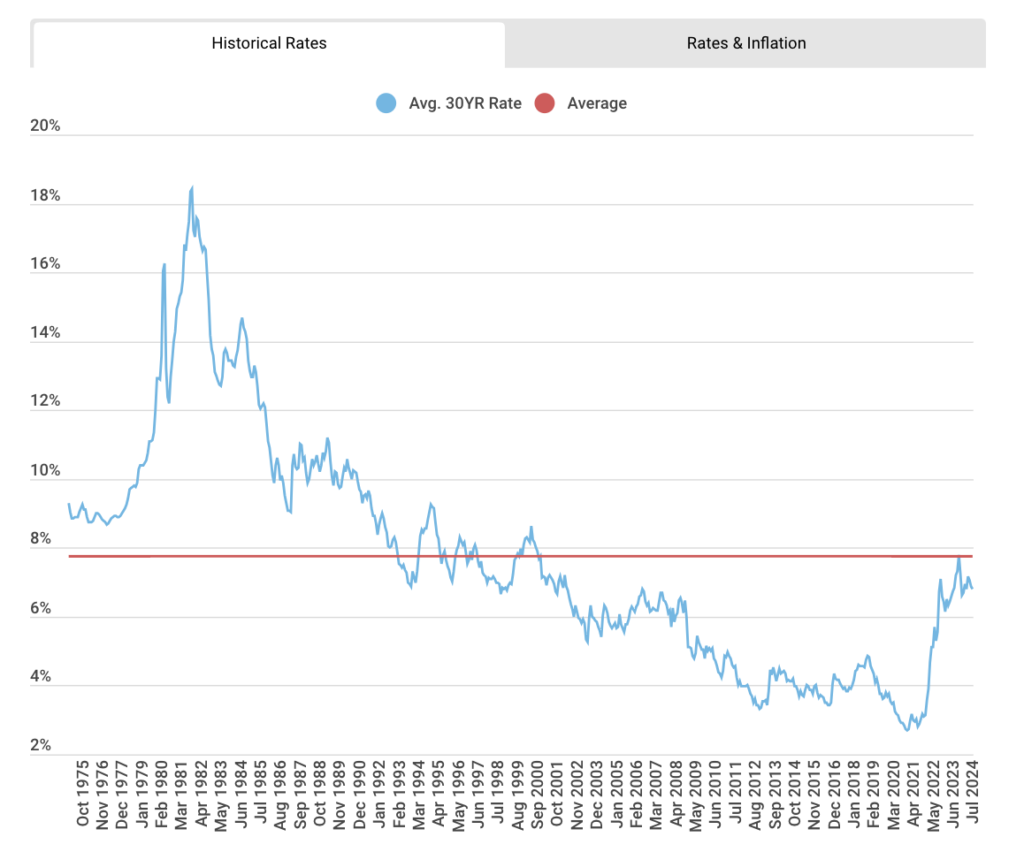

Many buyers are concerned about rates being high and getting a “bad deal.” Look at the following graph which shows a market average of just under 8 percent. Also, consider how inflation impacts interest rates. The market wants to know inflation is gone for good before rates will drop so there can be a delay in rates following inflation going lower.

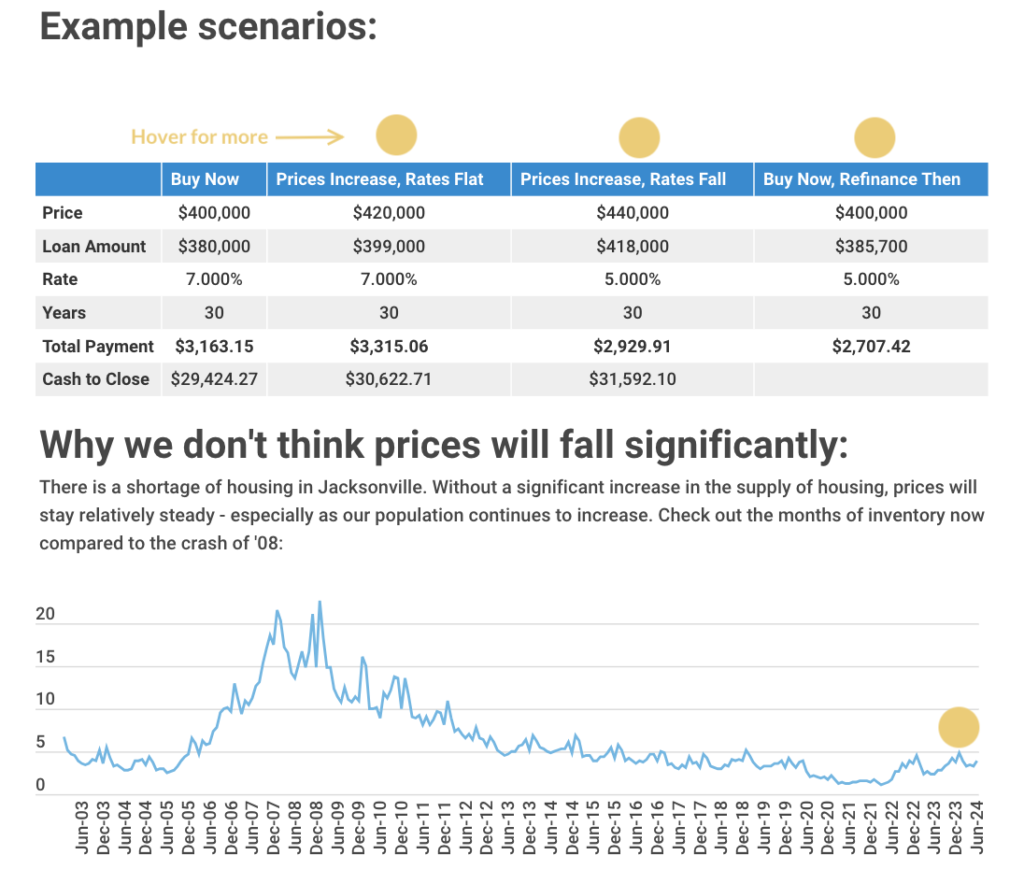

- Should I wait to buy a home when the market gets better?

It is highly unlikely that rates and prices would fall as a drop in rate will bring out the buyers and push prices higher as everyone bids to lock in the lower costs.

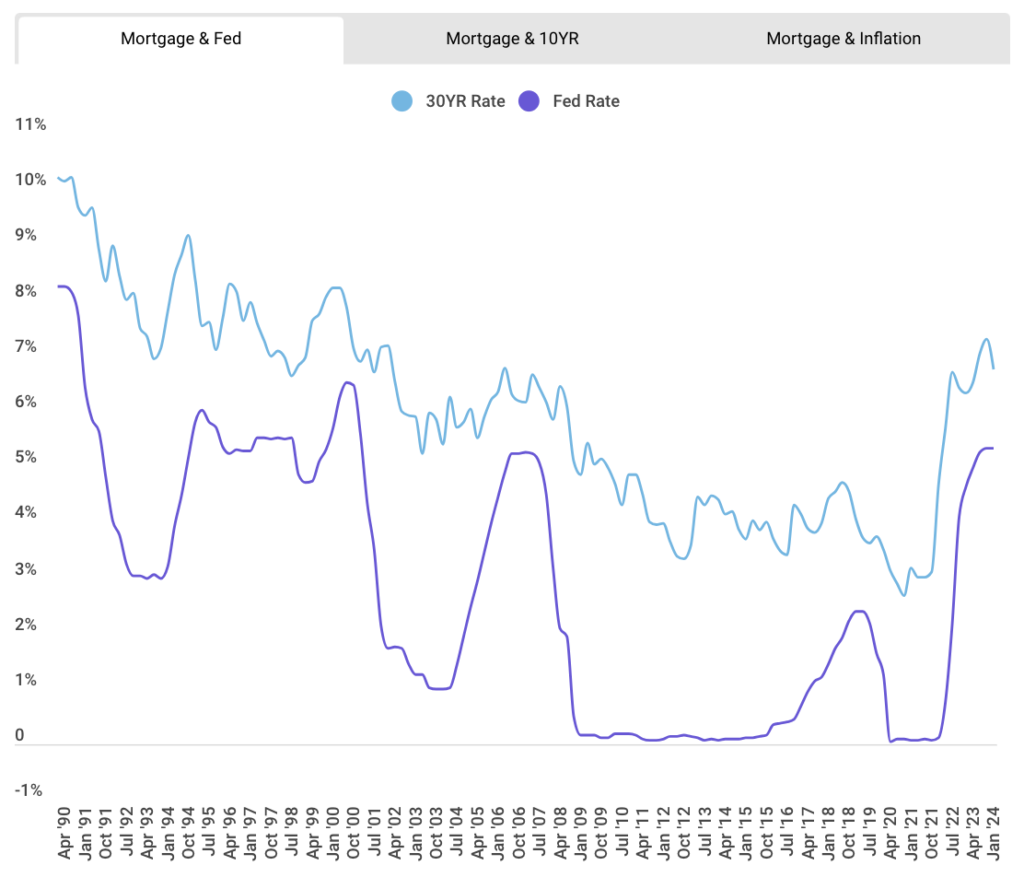

- If the Fed lowers rates, will that mortgage rates will go down?

A very common thought is that when the fed “lowers rates” (meaning lowering the federal funds rate) mortgage rates are immediately lower. While the Fed’s actions can impact mortgage rates, there are plenty of examples when the Fed lowers their rate and mortgage rates go up, and vice versa.

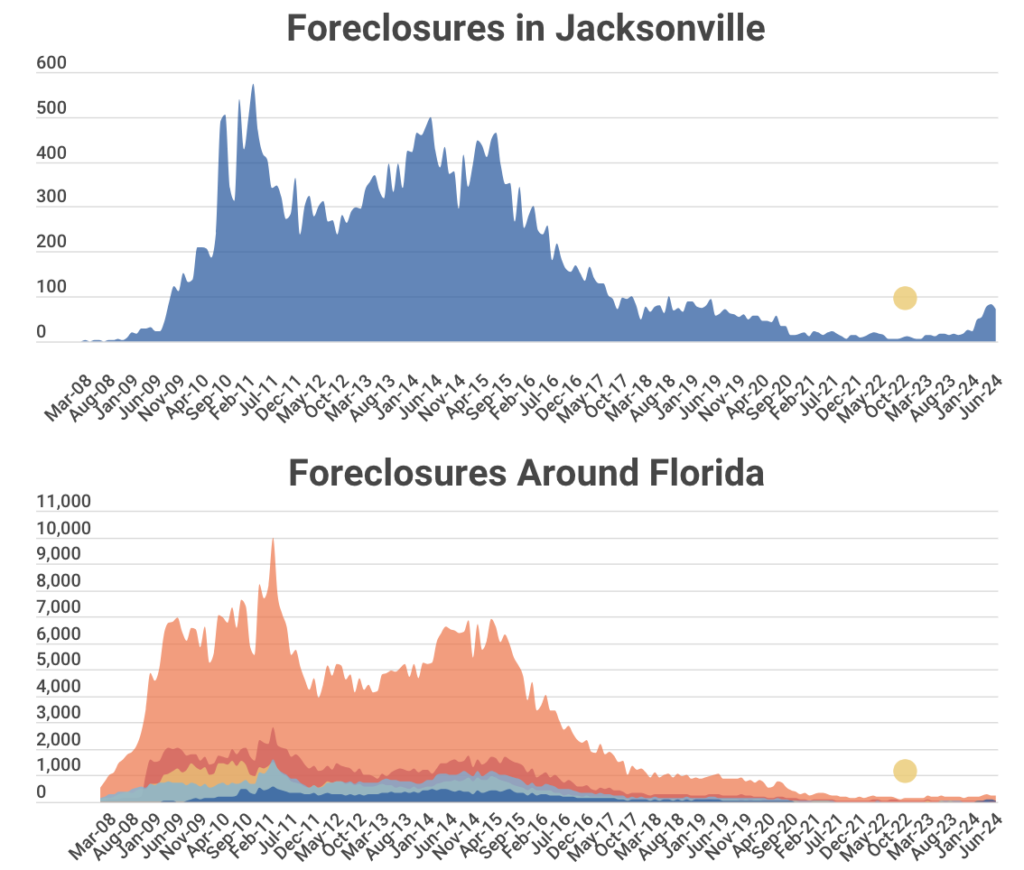

- Are foreclosures coming? Is the market going to tank?

For many, a repeat of the 2008 housing crash is a major concern. This is normal as it was a traumatic time and some would argue that the same issues that caused the crisis still exist today. Reviewing the latest foreclosure data can help address concerns about another big crash.

- What about all the layoffs I’m hearing about? Is this the right time to sell?

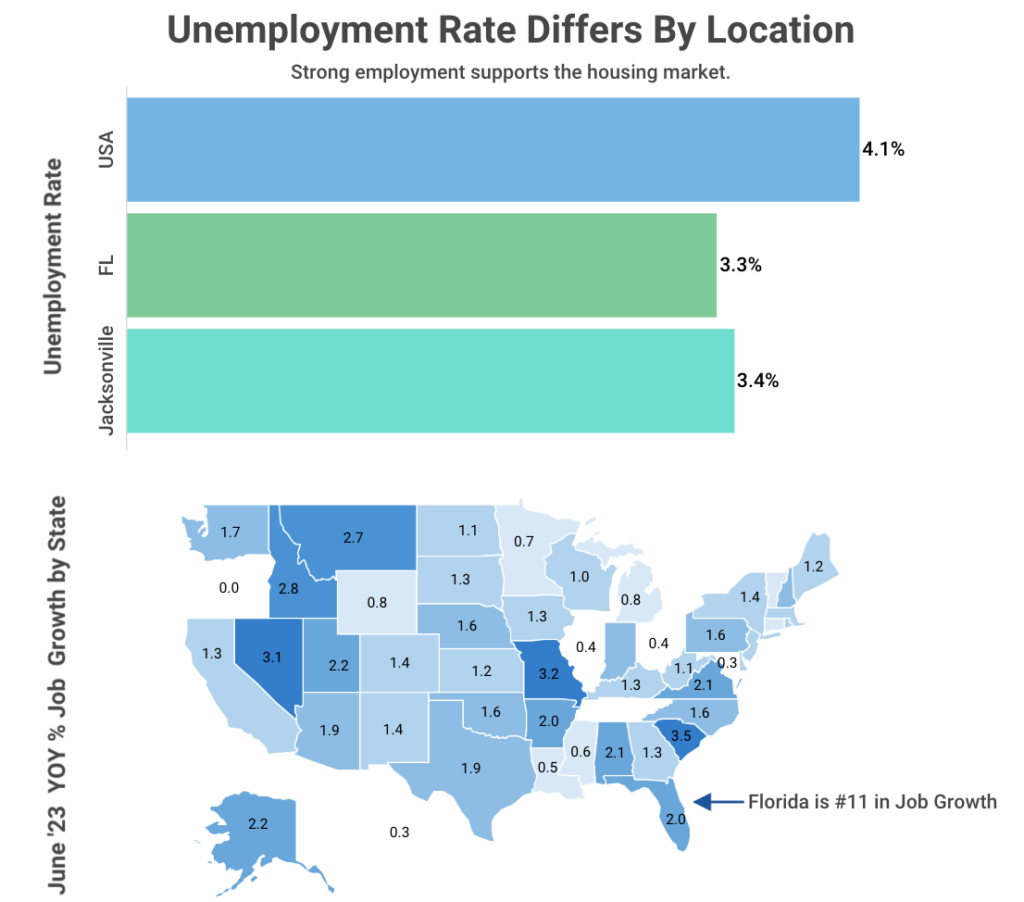

With headlines in the national media focusing on layoffs and recession concerns, we are reminded that economies and real estate are extremely local.

In the graph, you’ll see how Jacksonville compares to the rest of the state and nation on unemployment as well as how the state continues to grow jobs compared to the rest of the country. Both of these are powerful for keeping the real estate market strong and weathering the higher rates.